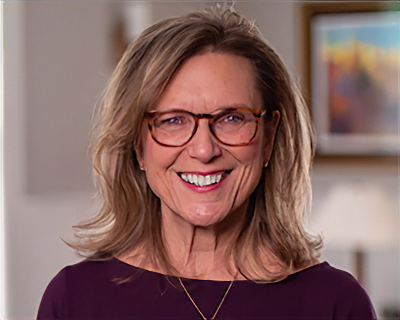

Senator Kushner Votes For Bipartisan Bill to Help Federal Employees During President Trump’s Government Shutdown

State Senator Julie Kushner (D-Danbury) and the Connecticut State Senate voted today on an overwhelming and bipartisan basis to financially help the estimated 1,500 federal employees who live and work in Connecticut but who have been furloughed without pay due to President Donald Trump’s ongoing federal government shutdown.

The Senate voted 32-1 in favor of House Bill 5765, “AN ACT ESTABLISHING THE FEDERAL SHUTDOWN AFFECTED EMPLOYEES LOAN PROGRAM AND PROVIDING ADDITIONAL ASSISTANCE TO FEDERAL EMPLOYEES.”

This bill was sponsored by all six legislative leaders from both the Democratic and Republican caucuses, and was crafted with the input and endorsement of Governor Ned Lamont and the Connecticut Bankers Association.

“This is a critical bill to help working families meet their financial obligations at a very stressful time in this country,” said Sen. Kushner, who is Senate Chair of the Labor & Public Employees Committee. “I’m really proud of Connecticut stepping up with this bill. Not everyone is in a position to fall back on a big savings account to get them through a financial emergency.”

The bill—which became effective immediately upon Governor Ned Lamont’s signature—affects approximately 1,500 federal furloughed employees, non-furloughed employees, and furloughed employees who have been called back to work—including federal corrections workers employed in Sen. Kushner’s Senate district.

The new program calls for the Connecticut Housing Finance Authority (CHFA) to guarantees loans to eligible employees from private banks. The loans are equal to $5,000 or the regular monthly take-home pay of an employee (whichever is lower), minus any unemployment the employee may be receiving.

Eligible employees may receive up to three loans, one for each 30 day period of the shutdown. Loans are interest-free for 270 days after the shutdown, and the loans must be repaid within 270 days of the end of the federal shutdown in three to six installment payments.

The State of Connecticut is guaranteeing just 10 percent of the aggregate amount loaned.

The bill also allows (but does not require) municipalities and/or special taxing districts to offer local tax deferment programs and/or water/sewer payment deferments to federal employees affected by the shutdown.

Share this page: