Looney & Duff Announce Proposal to Strengthen Connecticut’s Tax Fairness in Response to Federal Giveaways for the Wealthy

Hartford, CT – Today, Senate President Martin M. Looney and Senate Majority Leader Bob Duff announced a proposal to adjust Connecticut’s income tax code if new federal tax breaks for the ultra-wealthy go into effect. The proposal raises state income tax rates on high earners to ensure Connecticut can continue investing in its people, schools, and infrastructure while protecting working- and middle-class families from additional burden.

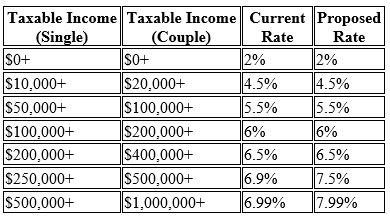

Under the proposed changes, income tax rates for the vast majority of Connecticut residents will remain unchanged. The new top brackets would take effect only if federal income tax rates for the wealthiest are slashed again, triggering the state-level adjustments. These higher state tax income brackets will apply only to families earning more than half a million dollars a year.

Specifically, the income tax rate for couples making between $500,000 to $999,999 and individuals making between $250,000 and $499,999 would change from 6.9% to 7.5%. Likewise, the income tax rate for couples making over $1 million and individuals making over $500,000 would change from 6.99% to 7.99%.

Under the last Trump administration, the wealthiest 1% in Connecticut saved $1.2 billion on their federal taxes annually after Republicans enacted their budget. Those individuals earned over $1 million annually and averaged $3 million annually. The next richest 4% in Connecticut (those who made $350,000 to $1 million) saved over $1.3 billion in federal taxes every year.

This proposed state-level tax adjustment would take effect only if similar federal tax cuts are enacted again. In that event, Senate Democrats propose increasing rates on the wealthiest to raise revenue for the state. This revenue will be significantly less than these individuals will save from any federal tax cut being considered. Unfortunately, this revenue cannot compensate for the hundreds of millions already cut in federal support to the state and the potential billions more.

“In the wake of yet another federal tax cut that overwhelmingly benefits the wealthiest Americans, Connecticut cannot afford to fail to take action at a time of crisis,” said Senate President Martin Looney. “Under the last Trump administration, Connecticut’s top 1% saved $1.2 billion in federal taxes, while working families saw crumbs. If Washington insists on handing billionaires another tax break, we will ensure some of that windfall comes back to the people of Connecticut to help deal with the massive federal cuts we anticipate.”

“Connecticut families shouldn’t have to pay the price for reckless decisions in Washington,” said Senate Majority Leader Bob Duff. “This is a proactive, conditional measure that protects core services, invests in education and infrastructure, and maintains a level playing field. If the wealthiest once again get a massive federal tax break, then it cannot be at the expense of hard-working Connecticut residents.”

Senate Democrats emphasized that the proposed tax increase on the wealthiest residents would generate significantly less revenue than those same individuals are expected to gain from pending federal tax cuts. However, even modest increases at the state level will help backfill the hundreds of millions already lost in federal support and help prevent deep cuts to essential state services.

FOR IMMEDIATE RELEASE

Contact: Kevin Coughlin | kevin.coughlin@cga.ct.gov | 203-710-0193

Share this page: