Senator Honig Issues Statement on Withheld Federal Funding for Local Schools

Senator Paul Honig, D-Harwinton, issued the following statement Friday in response to news that the U.S. Department of Education had withheld $499,817 in congressionally approved funding for local school districts.

“If my time in local government taught me anything, it’s that public education works best when our schools have stable, reliable funding,” Senator Honig said. “Towns across our district were counting on the federal support that’s been withheld by the U.S. Department of Education. When commitments like these are reversed, it creates serious challenges for districts already working within tight budgets. These federal dollars were intended to support students and educators, and their absence will be felt in classrooms across our region.”

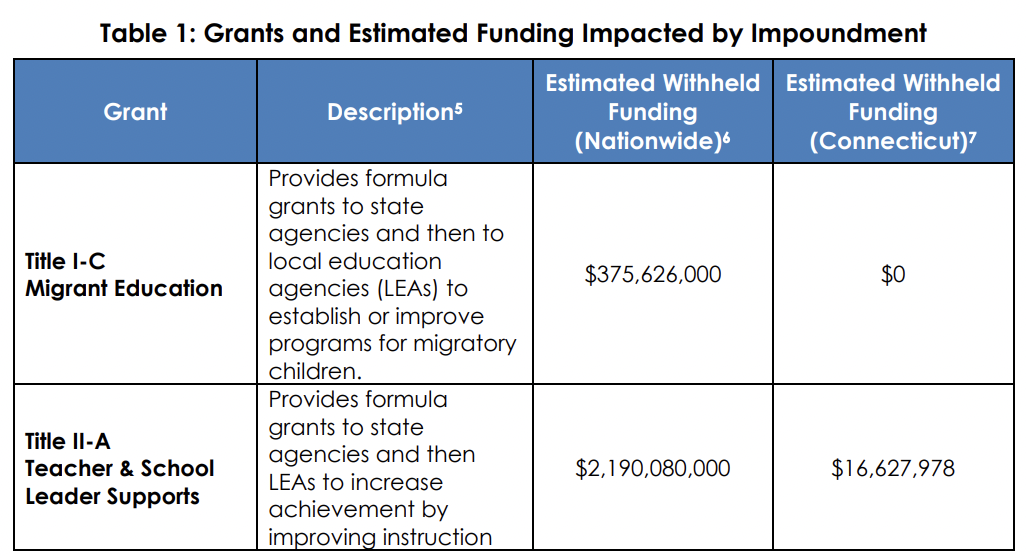

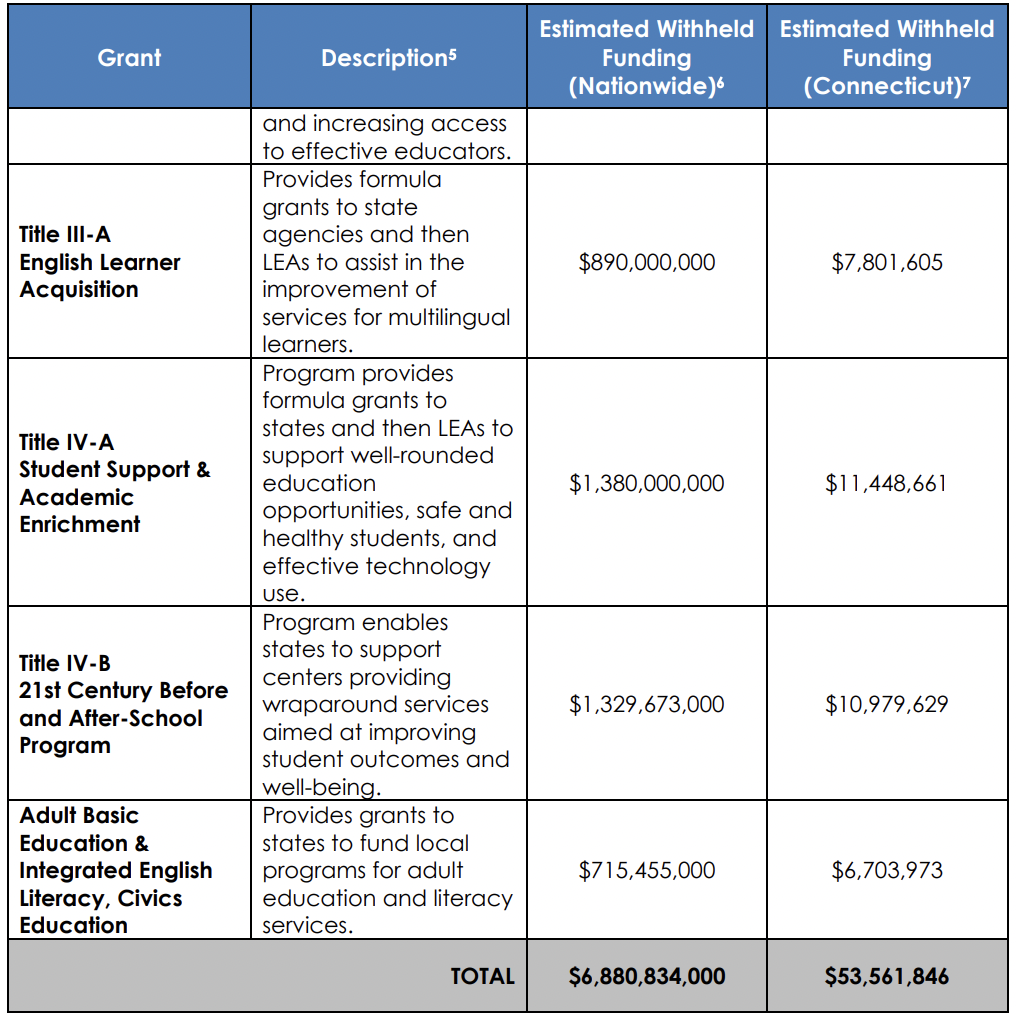

Senator Honig’s statement follows reporting by CT Insider, which detailed the town-by-town impact of the federal government’s decision to withhold roughly $53.6 million in approved funding from Connecticut schools for the 2025–2026 school year, affecting nearly every district in the state.

For towns in the 8th State Senate District, these cuts include:

Torrington: $317,814

Avon: $62,566

Canton: $30,577

New Hartford: $17,711

Simsbury: $71,149