West Hartford Delegation Secures Over $600k for Local Nonprofits

WEST HARTFORD – In the 2025 legislative session, the West Hartford delegation secured $610,316 for four local nonprofits. State Senator Derek Slap and State Representatives Kate Farrar, Tammy Exum, Jillian Gilchrest, Bobby Gibson and James Sánchez brought home grants for the following organizations over the next two years:

-$160,000 for West Hartford Pride

-$170,000 for Futures Inc.

-$130,316 for Playhouse on Park

-$150,000 for the Turning Points program at The Bridge Family Resource Center

West Hartford Pride celebrates, supports and protects members of the LGBTQIA+ community in the Greater West Hartford area through a number of initiatives and events. West Hartford Pride hosts an annual Pride Festival in June which serves as an opportunity to amplify the voices of the community, resist hate and center love and acceptance.

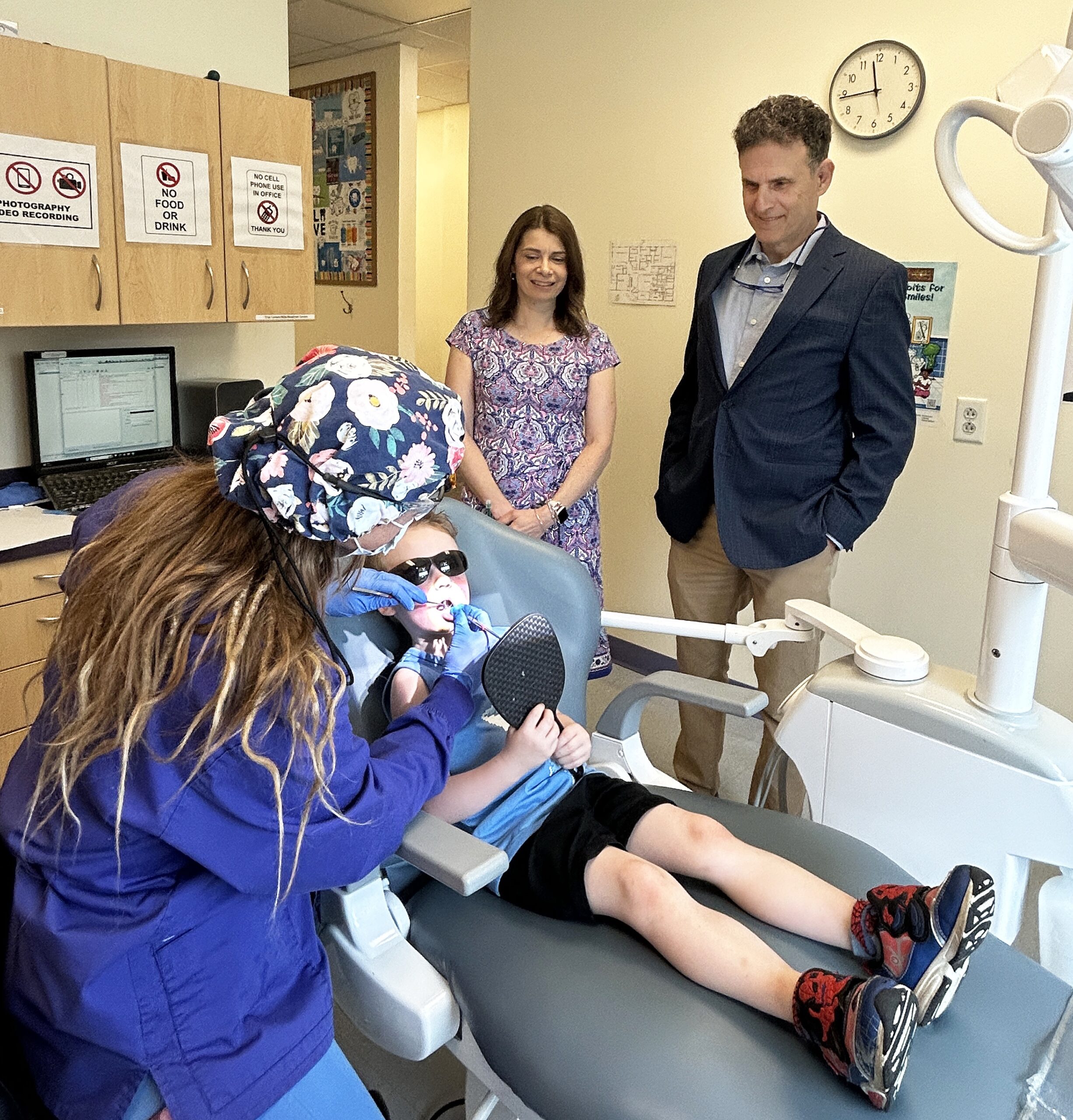

Futures Inc. is an organization which seeks to empower members of the disability community by creating growth opportunities and offering personalized supports for young adults and adults with disabilities. The Futures School in West Hartford is the state’s first community-based special education school for ages 14-22, and their adult programming offers employment and career training, as well as activities and socialization.

Playhouse on Park is a professional theatre that offers high quality entertainment at affordable prices, lowering barriers for residents of West Hartford and surrounding areas in experiencing the humanities.

Turning Points is a life skills program that provides critical interventions for at-risk youth from ages 4-20 to help them lead lives free from violence. The Bridge serves an estimated 800 youth that are supported by this program located at the West Hartford Teen Center, the Bridge’s Family Resource Center, and additional community settings. The Bridge provides age appropriate interventions and corresponding life-skills to the high risk youth in the community and the impact this funding has on those they serve goes beyond words.

“West Hartford has so many incredible organizations that provide invaluable services to our community,” said Sen. Derek Slap. “I am so pleased that my colleagues and I were able to bring home over half a million dollars to further the mission of four critical nonprofits that cultivate community, bolster the humanities and create a sense of belonging for everyone.”

“West Hartford’s diversity and commitment to inclusivity, ensuring everyone and anyone is welcome, is among its many strengths,” Rep. Tammy Exum said. “I think the funding designated for these nonprofits only serves as a confirmation of who and what the town is. I could not be more pleased to have worked alongside my colleagues to secure these funds.”

“These projects reflect a range of quality-of-life initiatives that are vital to many residents of West Hartford. Organizations such as Playhouse on Park, Futures Inc., West Hartford Pride, and The Bridge Family Center provide essential services—from arts and entertainment to health and personal well-being. I’m grateful that funding for these important programs was prioritized,” Rep. Jillian Gilchrest said.

“West Hartford is home to so many remarkable nonprofits. These organizations meet essential needs, cultivate community, create a true sense of belonging for every resident, and contribute to our robust economy,” said Rep. Kate Farrar. “This investment is about more than dollars. it’s about recognizing the heart and soul of West Hartford and ensuring our community continues to thrive.”

“I’m thrilled to see the funding coming to some of our amazing West Hartford nonprofits,” Rep. James Sanchez said. “This funding provides support and opportunity to our most vulnerable residents, backs our local arts and entertainment community, and prepares children for the future through mental health counseling, development programs, and much more. Thank you to all of my legislative colleagues for helping secure these critical funds for our community.”

“On behalf of the Playhouse Theatre Group, Inc. Staff and Board of Directors, I wish to express my profound gratitude to Governor Lamont and our Legislators for this generous and equitable increase to our Direct Line Item funding,” said Tracy Flater, Co-Founder and Executive Director, Playhouse Theatre Group, Inc. “The arts, including live theatre and theatre education are crucial to both the residents of CT and our surrounding community. Your investment will make a difference. Thank you!”

“The Board of Directors at West Hartford Pride is grateful to our delegation for fighting for, and providing resources that will help us connect our community with vital services and to provide the spaces where we can experience joy,” said Barry Walters, Founder and Co-Chair, West Hartford Pride.

“Futures Inc. continues to prioritize purpose and employment for individuals with disabilities of all levels of support needs through their MicroBusiness program. This grant will allow an expansion of the co-op program to allow individuals community and guidance as they work on self-employment endeavors,” said Darlene Borré, Futures Inc.